Leke’s Tenure

Chapter 2.2 Audio – Leke’s Tenure

Oyewole Olugbenga Leke’s Controversial Tenure at Global West

Goals and Objectives of the Estate of Romeo Itima

I understand that many inaccurate portrayals of my (Kevin Itima) motives and intentions have circulated over the years. Let me be clear: my father did not build this company alone—he worked tirelessly with the support of many others. The maritime industry, especially at the level my father pursued, demands significant capital, and he sacrificed nearly everything he had to ensure its success. We have never sought wealth through manipulation, dishonesty, or greed. To clarify, the Estate of Romeo Itima pursues the following goals:

- Accurately account for all income owed to or paid to Global West.

- Identify and verify outstanding debts.

- Ensure timely and fair payment of salaries to all Global West staff.

- Locate and confirm ownership of all assets purchased with Global West funds.

- Oversee the responsible liquidation of Global West assets.

- Ensure proper distribution to all legitimate investors.

- Facilitate equitable dividend distribution among rightful shareholders.

A Period Marked by Uncertainty, Frustration, and Resilience

In November 2020, amidst unsettling death threats from William Itima aimed at Romeo Itima’s family, the Estate reluctantly withdrew legal action concerning Global West. This concession marked the beginning of a turbulent period in the history of Global West, punctuated by mistrust, disappointment, and perseverance.

Unexpected Return & Ambiguous Intentions

Following the sudden passing of Winfred Itima in October 2023, Oyewole Olugbenga Leke resurfaced, unexpectedly reaching out to Romeo Itima’s family, seeking their support for his bid to become the Managing Director of Global West. This was met initially with cautious optimism tempered by skepticism, given Leke’s previous disengagement and perceived abandonment after Romeo Itima’s death.

Timeline of Events Leke vs. Estate of Captain Romeo (Global West Dispute)

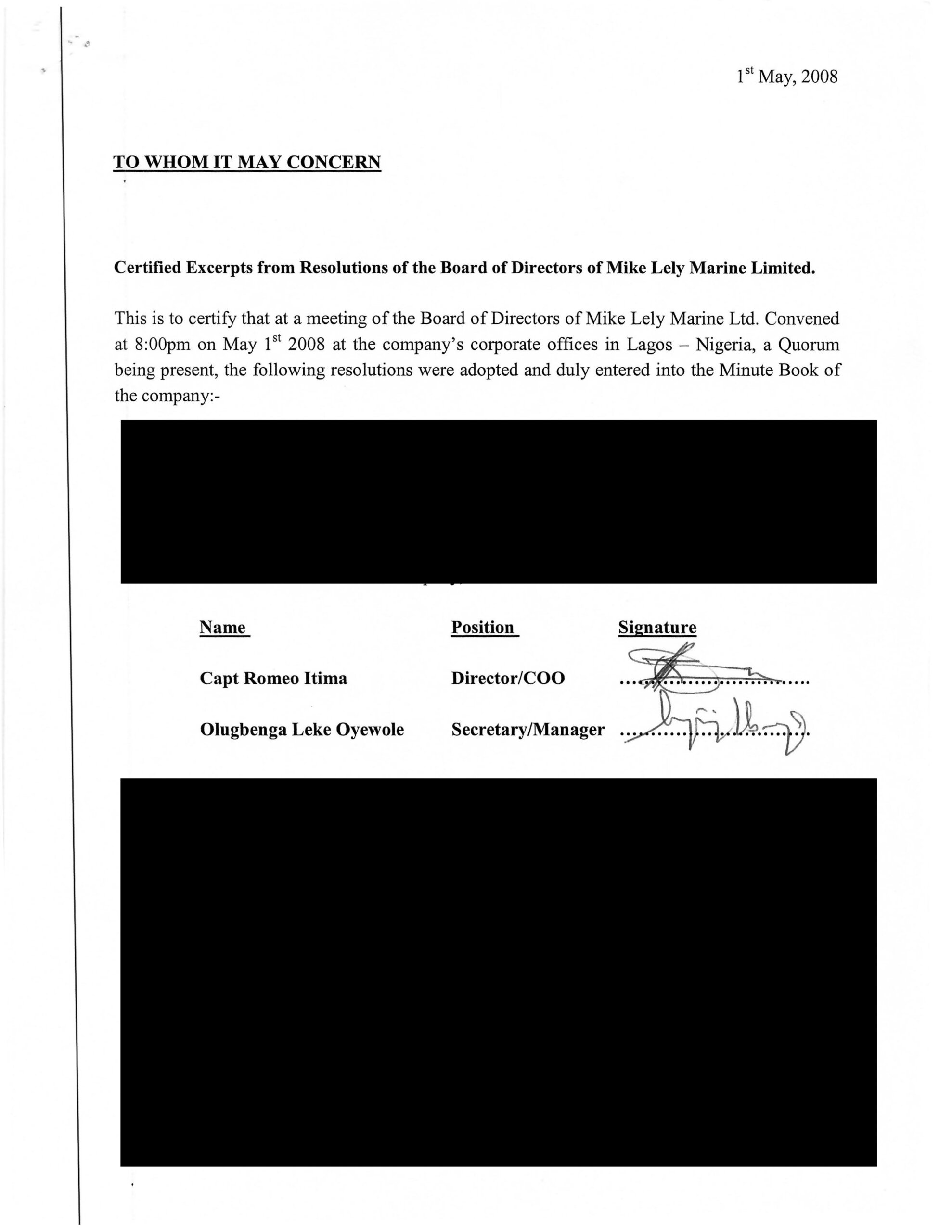

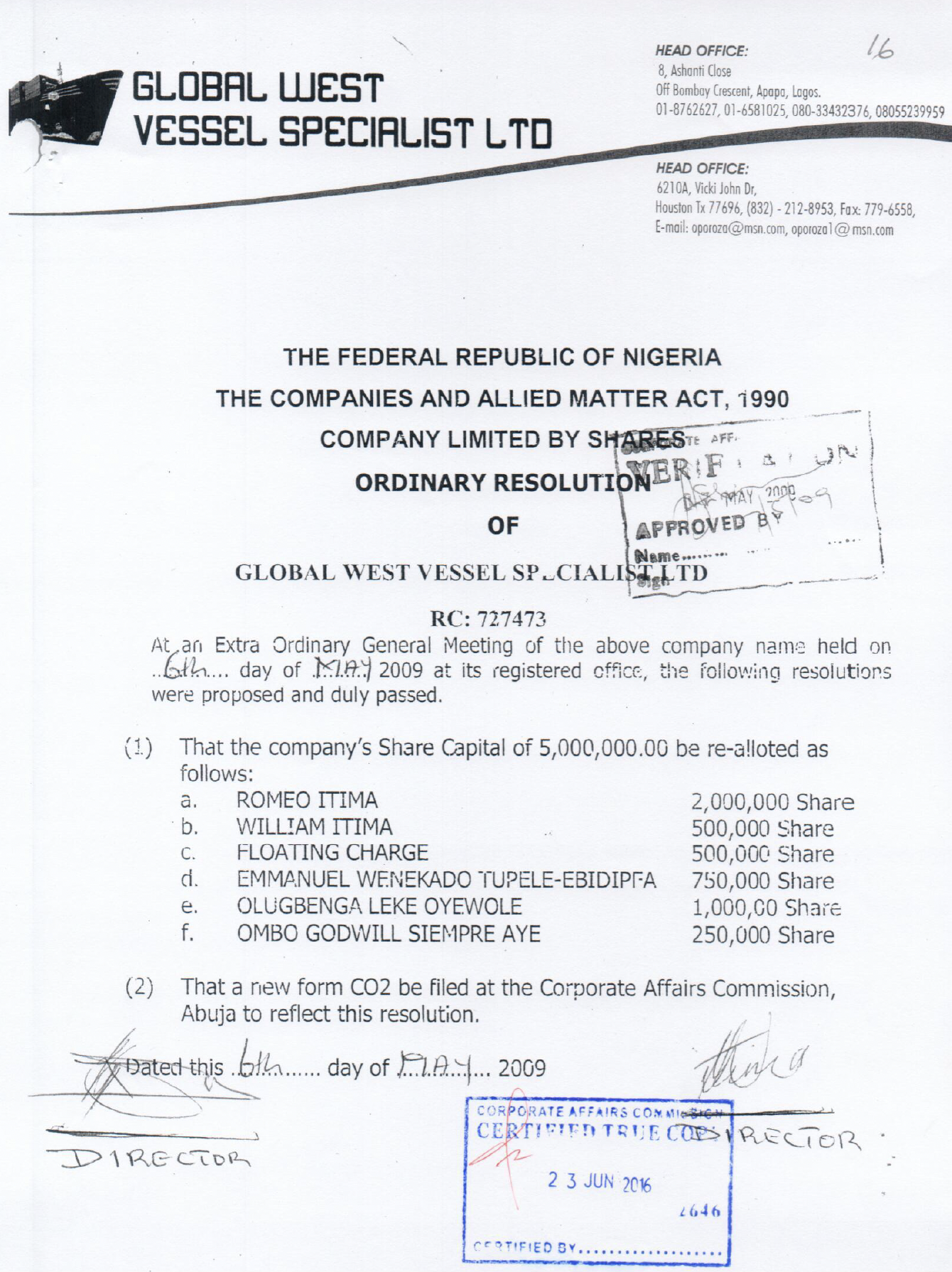

Leke's Corporate History

Shareholders Meeting: Transparency or Deception?

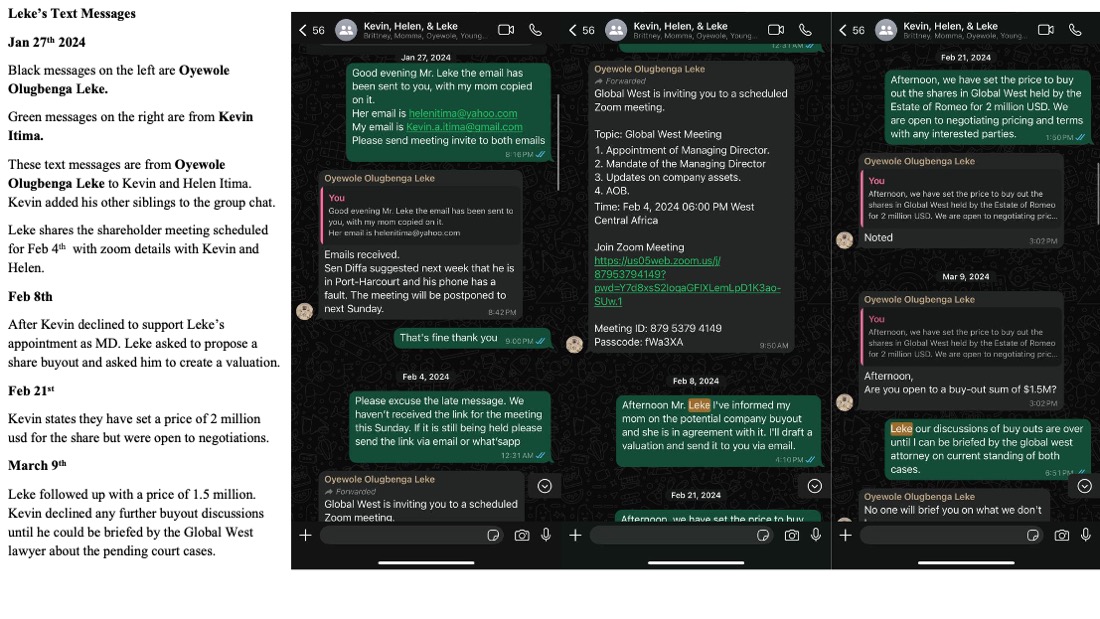

On February 4, 2024, shareholders convened virtually, purportedly to discuss Global West’s corporate affairs. Instead, the meeting swiftly pivoted into a vote on Leke’s appointment as Managing Director—a move that blindsided Romeo Itima’s estate. Despite legitimate inquiries about Global West’s current financial status and operational details, Leke provided unsatisfactory and evasive answers, leading Romeo’s Estate to withhold their vote.

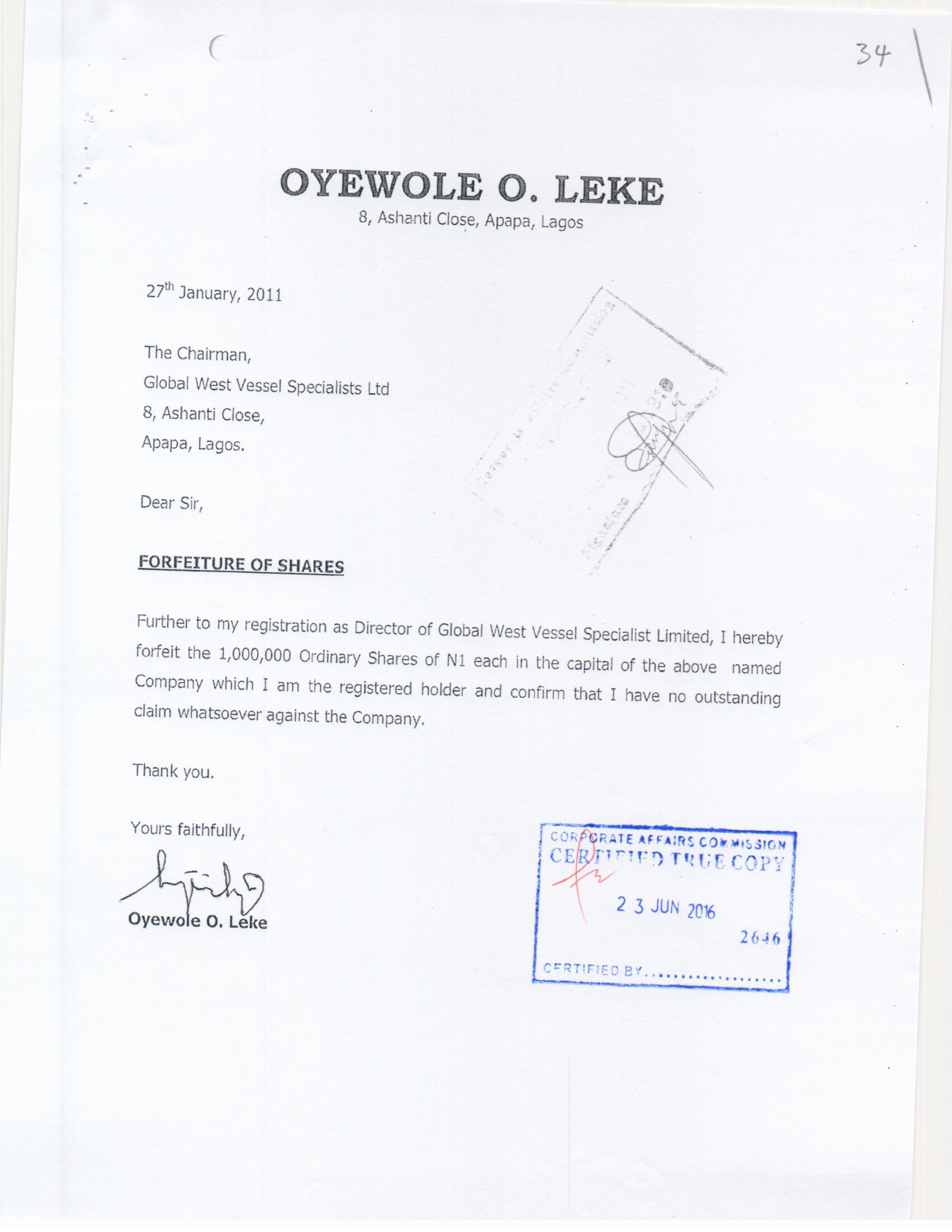

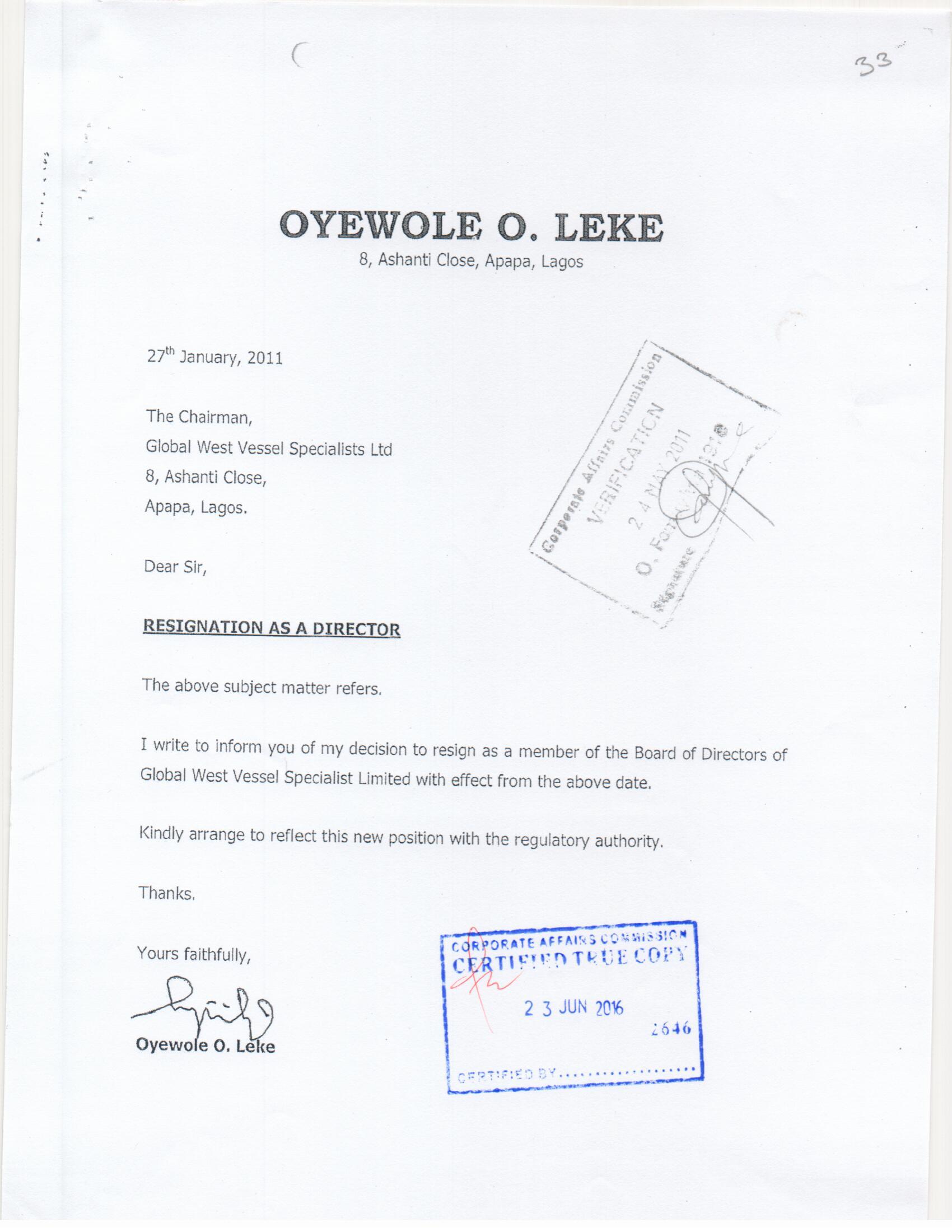

Unbeknownst to the Estate, Leke had secretly secured support from two shareholders in November 2023, concealing critical facts, including his resignation and forfeiture of shares dating back to 2011—a revelation that only surfaced later in 2024.

Watch the full Shareholders Meeting

Communication Breakdown & Exasperation

Post-meeting negotiations saw Leke proposing to buy out the Estate’s shares. Although the Estate communicated openness to negotiate, Leke failed to respond adequately, instead selectively sharing incomplete information. Each subsequent request for clarity was met with increasing annoyance and evasion, deepening mistrust and frustration.

The Estate of Romeo Itima, while fully respecting collective ownership, rightfully insisted on transparency as legally mandated under Nigeria’s Companies and Allied Matters Act (CAMA 2020). Yet, basic financial disclosures, clear communication on asset statuses, and corporate governance details consistently remained elusive under Leke’s management.

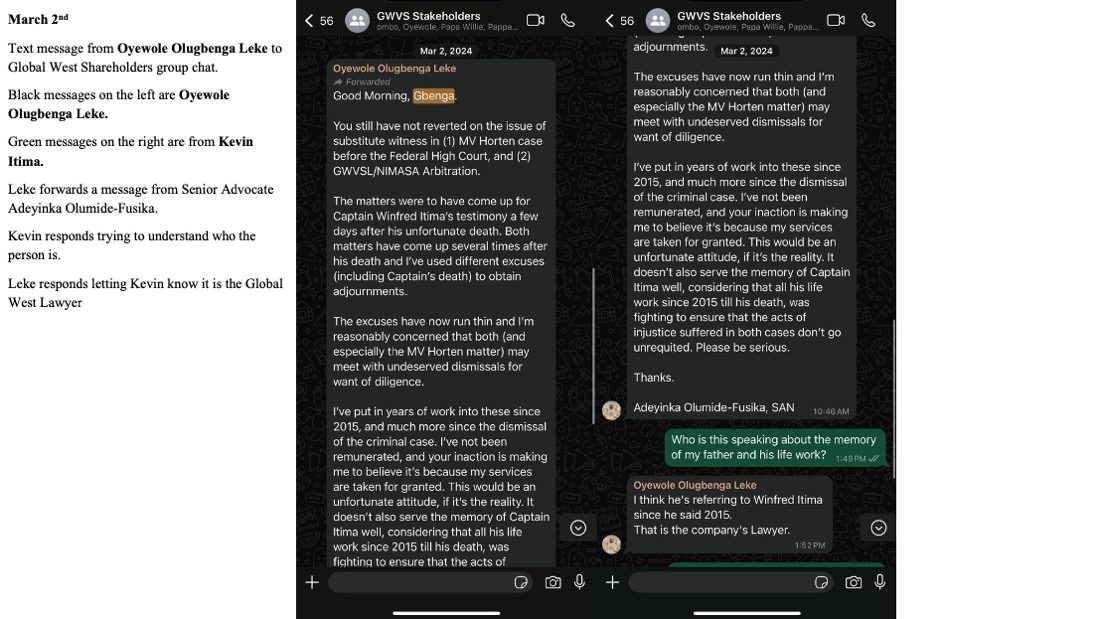

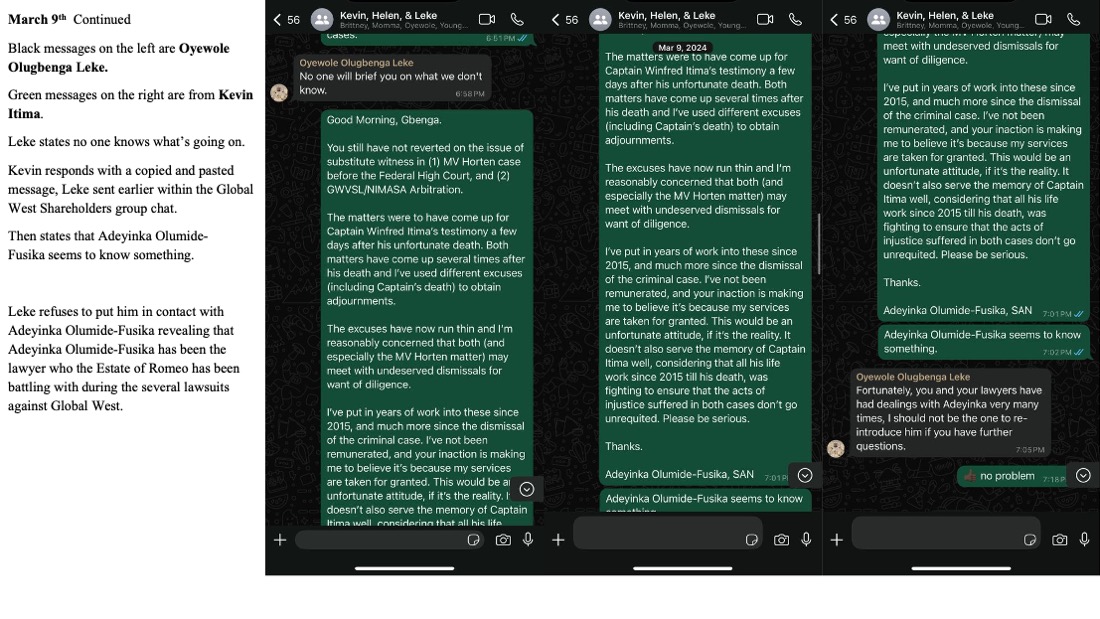

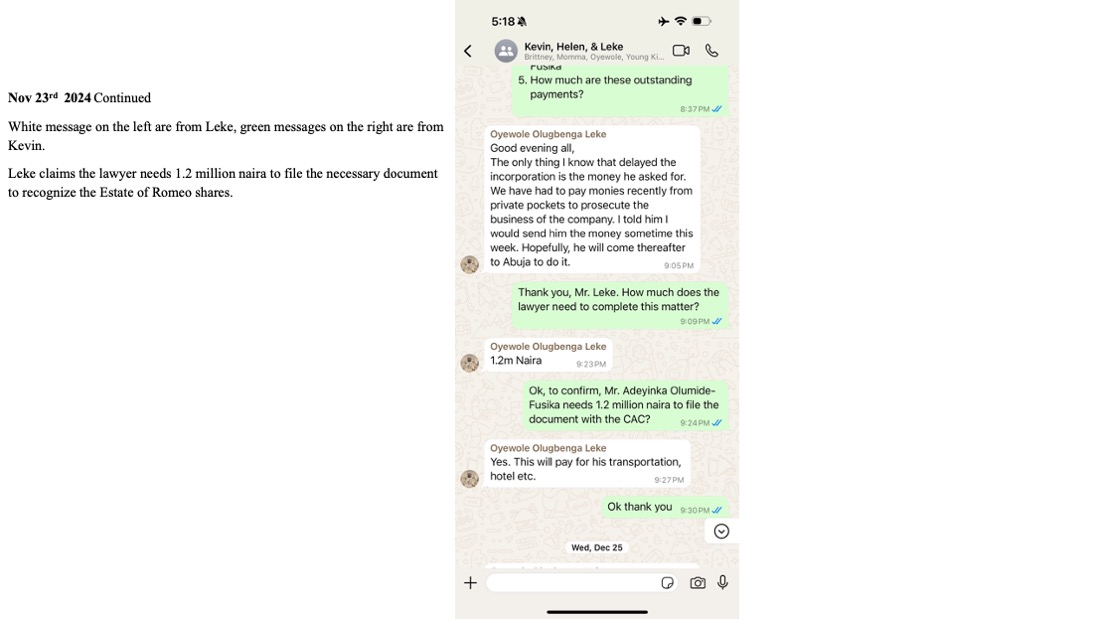

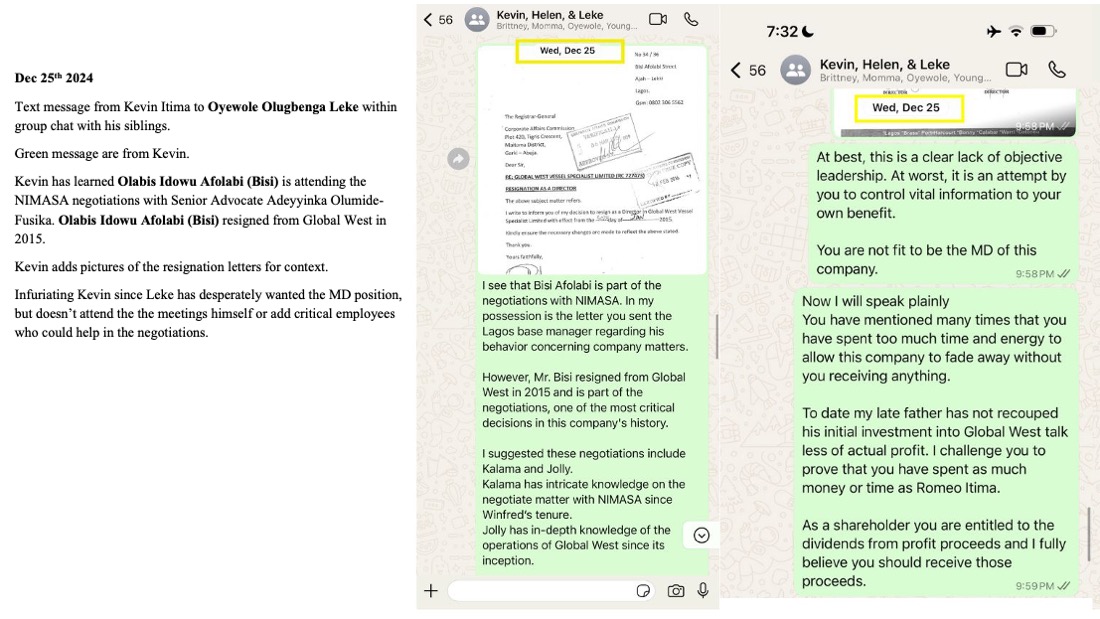

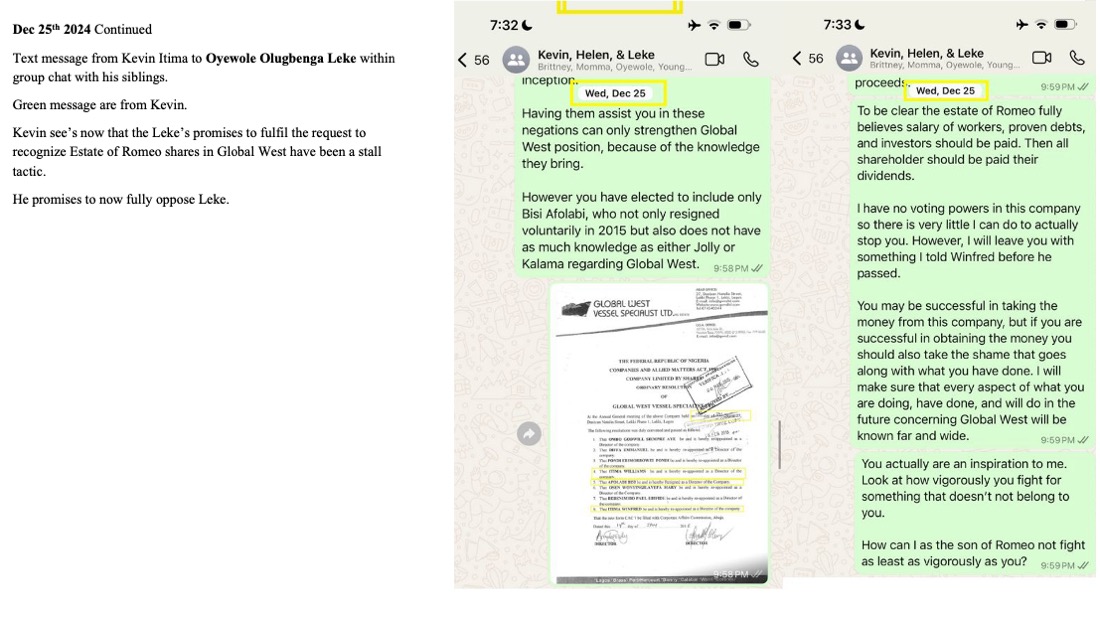

Whatsapp Messages From Mr. Leke

Seeking Transparency: Upholding Romeo Itima’s Legacy at Global West

For the rest of 2024, Leke continued serving as Managing Director (MD). Although I did not support Leke becoming MD, I suggested he include Jolly, the Operations Manager, as part of his team. Jolly had the right skills and had been working closely with my father since the early days of Global West. Instead, Leke chose to bring back Mr. Bisi, who had resigned from the company in 2015.

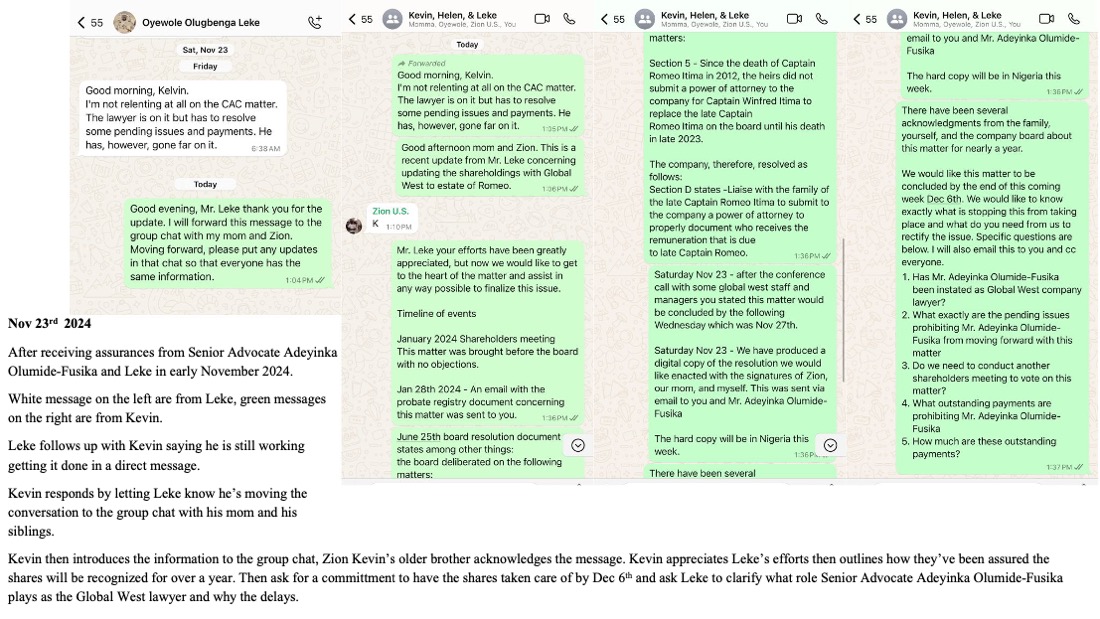

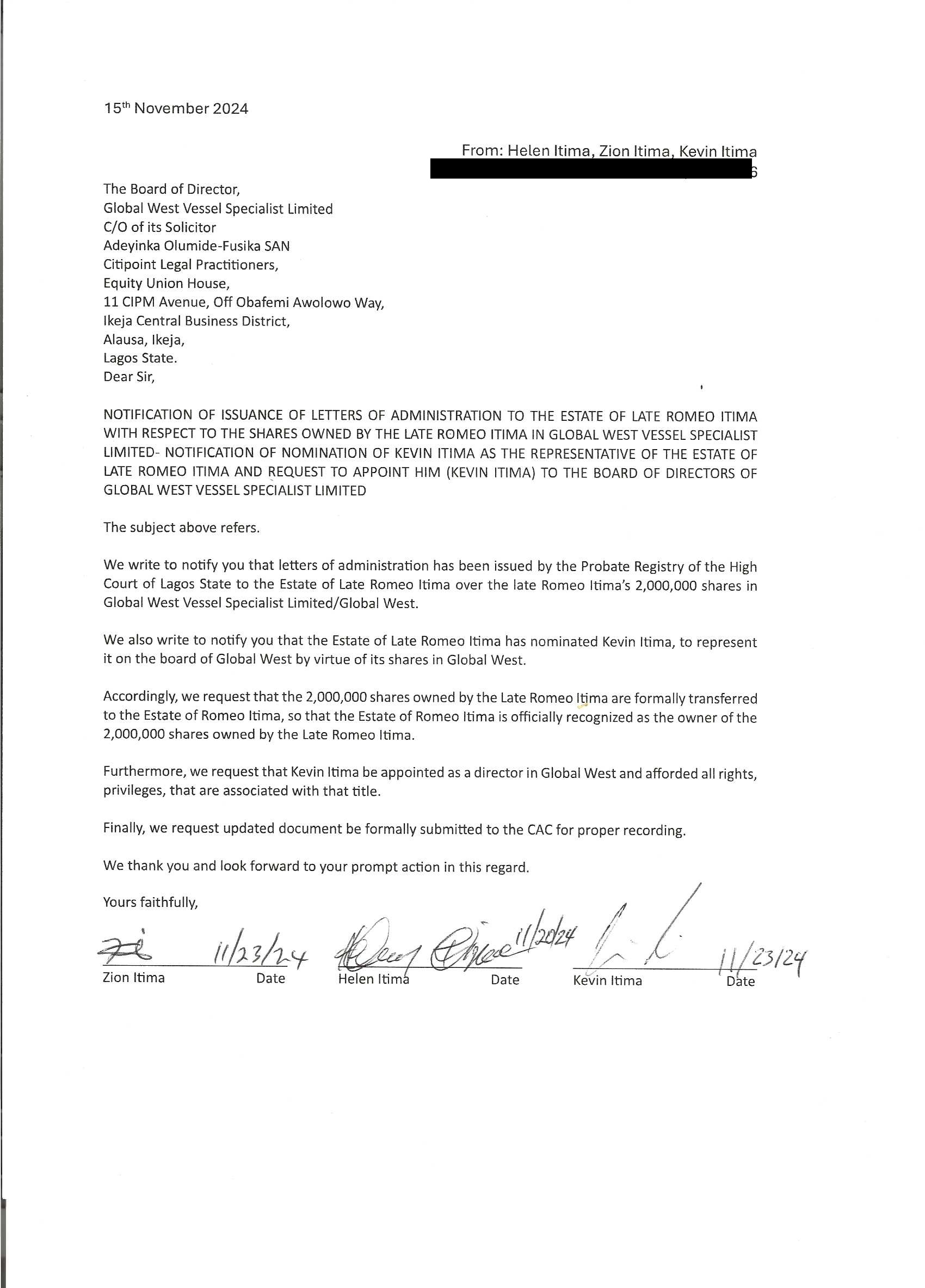

In November 2024, I finally spoke directly with Global West’s lawyer, Senior Advocate Adeyyinka Olumide-Fusika. During a conference call attended by my attorney. The lawyer assured me he was committed to ethical practices and stated clearly that his actions reflected the wishes of his client, Global West. He emphasized that he had observed no unethical behavior by the company. When I expressed my concerns and my desire for transparency, he assured me there should be no issue and suggested cooperating with Leke would yield the best outcome.

Encouraged by this sincere conversation, I decided to try once more.

Trying to Reengage with Mr. Oyewole Olugbenga Leke

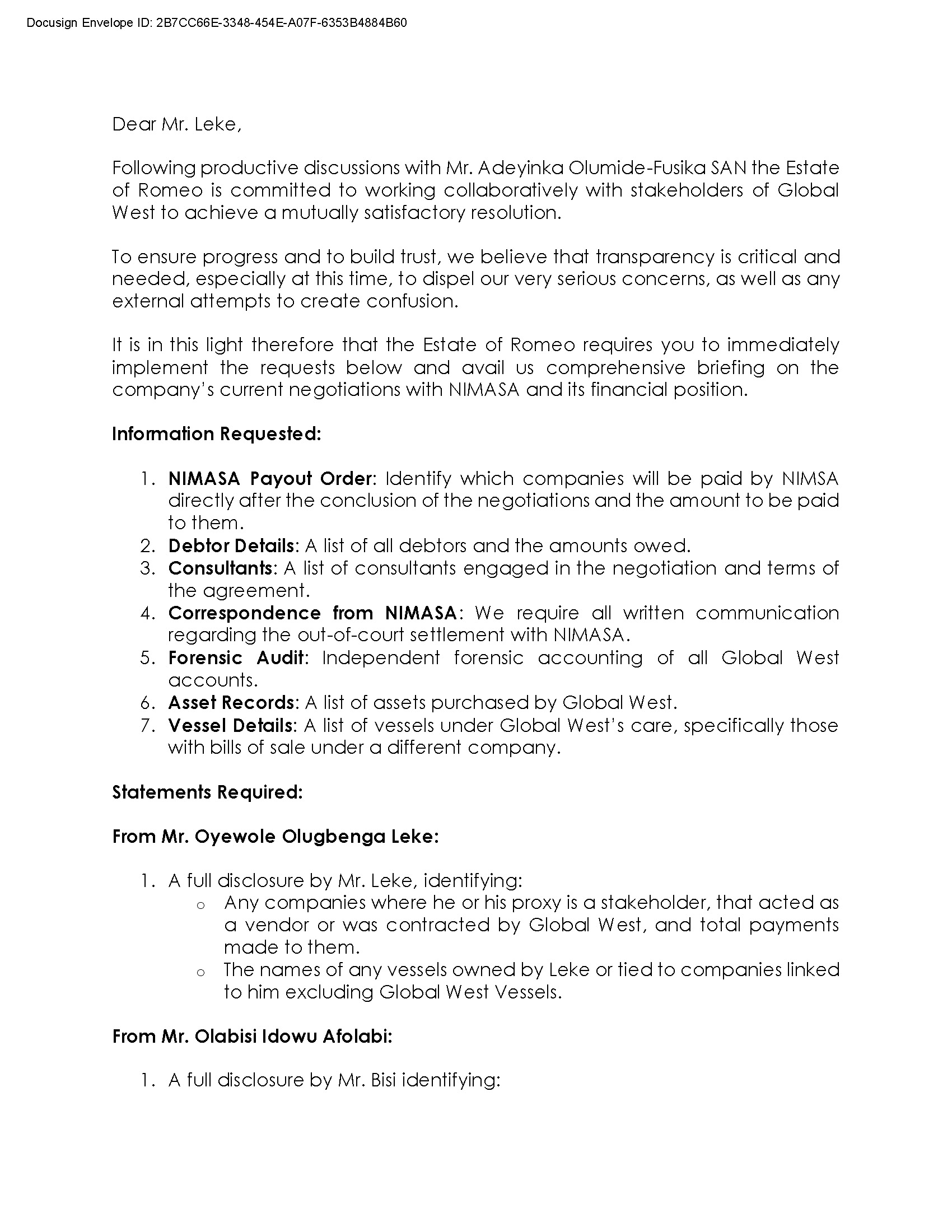

On January 16, 2025, I reached out to Mr. Oyewole Olugbenga Leke by email to ask basic questions I believed any Managing Director of a year should be able to answer. I waited more than a month for a clear explanation, but his replies were just as incomplete as before. They never addressed the main issue: who does Global West owe money to, and how much do they owe?

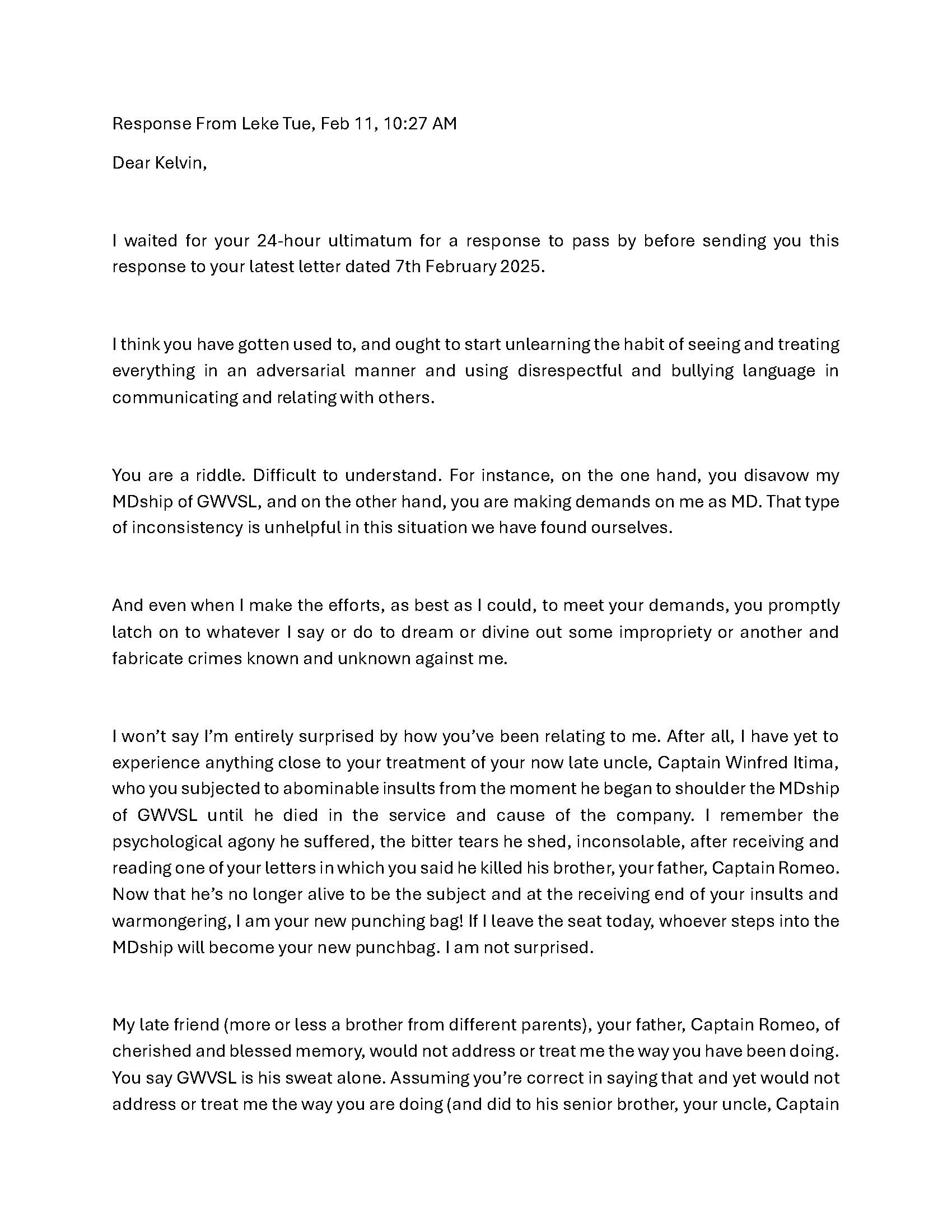

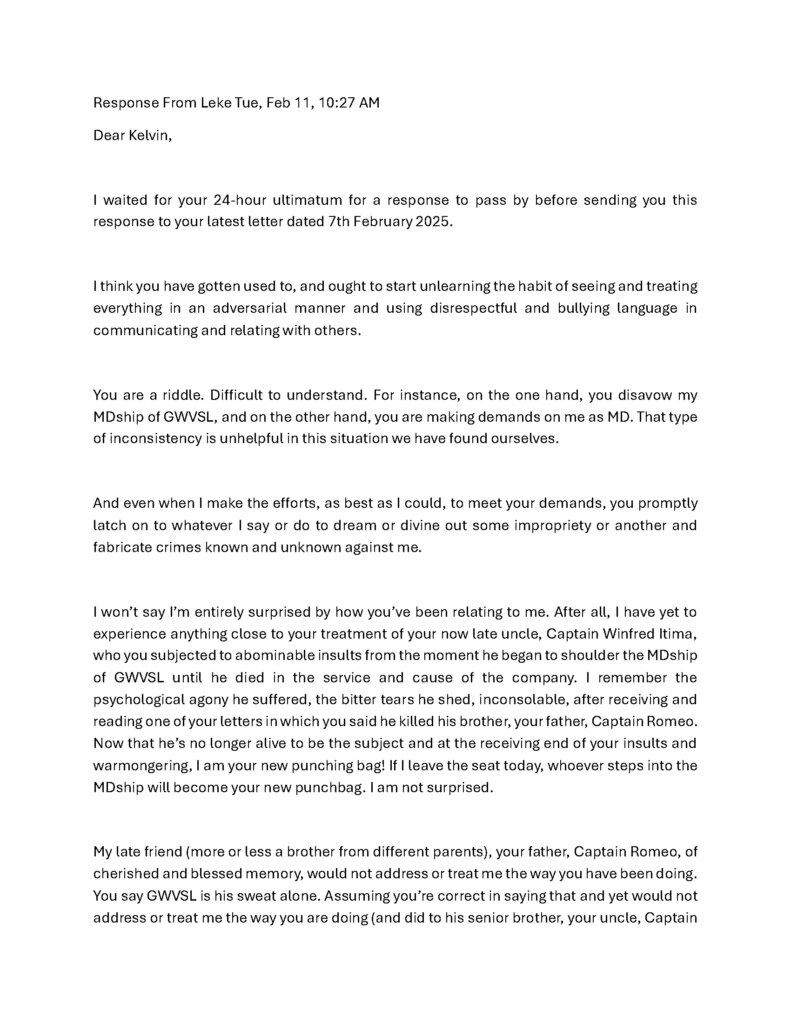

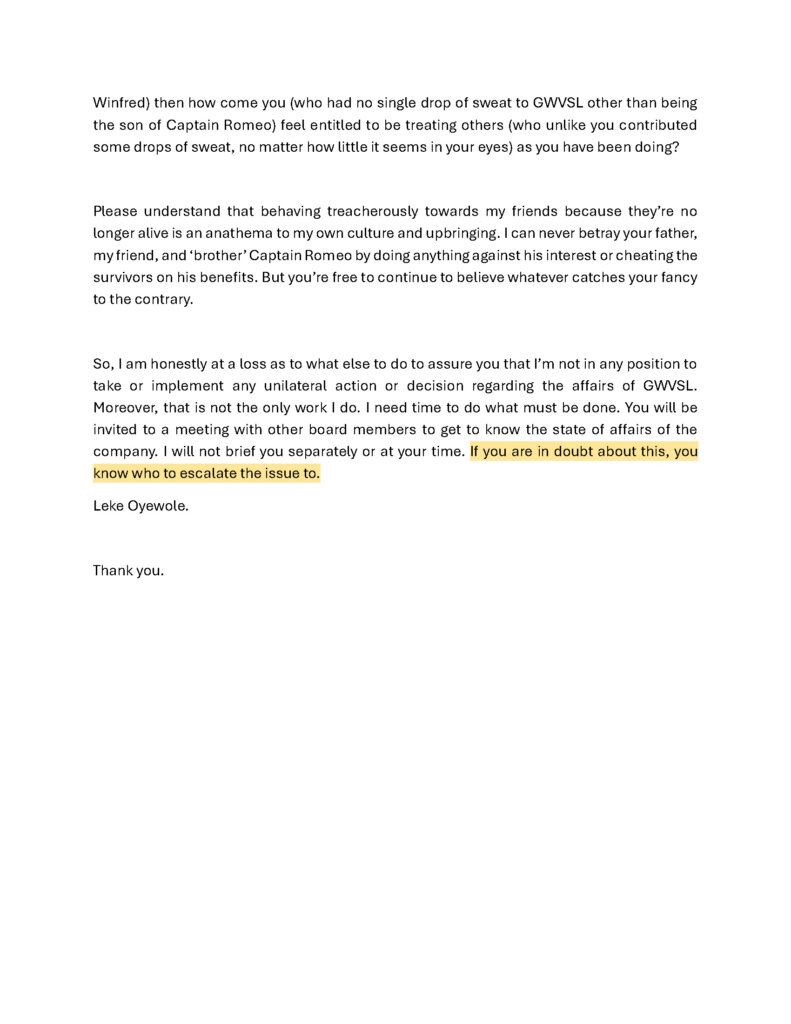

By February 9, my patience had run out. I sent Mr. Leke a formal demand letter, giving him 24 hours to answer these questions clearly or face legal action. His final response once again painted me as “irrational” and a “bully,” and his tone seemed even more extreme. I also found it strange that the board resolution from June 2024, which named him Managing Director, was signed by only one director, Rear Admiral Ombo. If Mr. Leke were truly doing his job, all shareholders would have been informed about the company’s finances by now. Six months should be enough time to gather financial information and share it with shareholders.

His last statement suggested there was no reasoning with him and hinted at a deeper plot: “If you are in doubt about this, you know who to escalate the issue to.” I believe he was referring to my uncle, William Itima, who once threatened my life. Mr. Leke was not present during that threat, and I never told him about it, so I can only assume my uncle shared the details with him.

Sadly, this behavior seems to continue the legacy left by my uncle Winfred, and now Mr. Leke has picked up where he left off. They use laws and procedures when they find it helpful, but ignore them otherwise. They act like respectable businessmen while treating me like a child with no right to ask questions about the company my father built, in which we now hold a majority share. Yet, under the Companies and Allied Matters Act (CAMA) 2020, shareholders have every right to seek information. It is frustrating that, even after 13 years, we cannot get straight answers.

What about the Other Shareholders?

What about the other shareholders? Even after my uncle William threatened me, I tried reaching out to him again. I explained that, even if he and the other shareholders do not trust me, they should at least demand proper answers from Mr. Leke and judge for themselves. I have shared certified true copies of many documents to back up my claims, but it seems they would rather not know the truth.

Companies and Allied Matters Act (CAMA) 2020

Under the Companies and Allied Matters Act (CAMA) 2020, shareholders (members) rely on various categories of information to make informed decisions and exercise their rights. Below is a consolidated view of the critical information that must be disclosed or made accessible to shareholders:

- Annual Financial Statements: Directors are mandated to prepare annual accounts, including a balance sheet, profit and loss account, and notes (section 377) that give a “true and fair view” of the state of affairs of the company (section 378). These financial statements must be laid before the company in general meeting (section 388) and must be filed with the Corporate Affairs Commission (CAC) along with the annual return.

- Auditors’ Report: In addition to the financial statements, the auditors’ report is presented and read at the general meeting (section 388(2)). Shareholders are entitled to receive or inspect this report, which indicates whether the financial statements comply with the Act’s requirements (sections 404 and 398(2)–(5)).

– Citations:

Shareholders are entitled to receive notice of general meetings at least 21 days before the meeting (sections 241–244), including the agenda, proposed resolutions, and any relevant documents. They must also be notified about any extraordinary general meeting (sections 239–240).

– Citations:

Any shareholder, whether or not entitled to have copies of the financial statements delivered automatically, can request a copy of the most recent financial statements and must receive it within seven days of the request (section 392). Failure to comply exposes the company and its officers to a penalty.

- Content: Companies must deliver an annual return to the CAC containing key information—registered address, share capital structure, indebtedness, list of past and present members, particulars of directors and secretaries (sections 417–420, and Seventh Schedule).

- Access to Annual Return: The annual return is an important publicly filed document and can be accessed to review company structure, membership, and governance data.

– Citations:

- Register of Members: Maintained under section 109; shareholders can inspect it (sections 110–112).

- Significant Control Disclosure: Members must be informed of persons with significant control over the company through statutory disclosures (sections 119–123).

– Citations:

The directors’ report is included with the annual financial statements and must cover, among other things, the state of the company’s affairs, recommended dividend, changes in property, names of directors, policies regarding employees, and more (section 385). It also provides details on employee matters, health, safety, and welfare (First Schedule and Fourth Schedule references).

– Citations:

- Directors and Secretaries: Appointment, removal, and qualifications must be disclosed in filings (sections 271–283 for directors, 330–340 for secretaries).

- Directors’ Interests and Remuneration: Loans to directors, directors’ shareholding, and remuneration must be disclosed (sections 301, 383–384).

– Citations:

Any alteration to share capital, issuance of new shares, or rights attaching to shares must be disclosed, particularly as part of annual returns or via updates to the company’s register of members (sections 124–129, 142–143).

– Citations:

Certain significant corporate actions, such as major asset transactions (section 342) or arrangements (Part XXVIII on “ARRANGEMENTS AND COMPROMISE”), must be disclosed to shareholders, and they often require a resolution passed at a general meeting.

– Citations:

In the event of winding-up proceedings, notices and material details regarding the company’s status must be disclosed. Members can verify the winding-up status via official filings and court orders (sections 564 onwards).

– Citations: Various sections in Part XX (Winding Up).

Below is an outline of shareholders’ (referred to in the Act as “members”) rights under the Companies and Allied Matters Act (CAMA) 2020, together with references to the relevant sections and page numbers in the Act:

Under section 138(b), each share in a company carries with it the right to attend any general meeting and vote at such a meeting. This right is further elaborated in section 107 (right of member to attend meetings and vote), which clarifies that members are entitled to receive notices of meetings and to participate in person or by proxy.

– Sections: 107, 138(b)

– Pages:

- Section 107 is on page A 6 (snippet heading “CHAPTER 6—MEMBERSHIP OF THE COMPANY”).

- Section 138 is on page A 97 (snippet heading “CHAPTER 8—SHARES AND NATURE OF SHARES”).

Section 139 affirms that a member’s shares or interests in a company are personal property and are transferable according to the company’s articles of association.

– Section: 139

– Page: A 97

By section 171(1)–(3), every company must deliver certificates of all shares allotted or transferred to each member within two months of allotment, or within three months of a transfer being lodged.

– Section: 171

– Pages: A 110–A 111

Section 142 stipulates that a company shall not allot newly issued shares unless the shares are first offered to the existing shareholders of that class in proportion to their existing holdings, unless those shareholders waive this right.

– Section: 142

– Pages: A 98–A 99

Dividends are “special debts” due to and recoverable by shareholders under section 432, and members have the right to sue for dividends if they are declared but not paid.

– Sections: 426–432

– Page references:

- Section 432 specifically is on page A 243 in the snippet.

If the company is wound up, shareholders have a right to a share in the company’s remaining assets after all debts and liabilities are settled. The exact distribution depends on the rights attaching to their shares (for instance, preference shares may have priority). This is addressed in multiple sections dealing with winding-up, but members’ rights generally appear under sections 568–570 and under sections on share classes and entitlements (for instance, sections 138 and 168–170 on class rights).

– Pages: See “WINDING-UP” references beginning around page A 21–A 23 in the arrangement of sections (noting that the Act’s text on winding-up is quite lengthy).

Sections 341–347 address minority protection and derivative actions, giving members the right to sue on the company’s behalf in certain circumstances (for example, if the board refuses to act).

– Sections: 341–347

– Pages: These appear under “PROTECTION OF MINORITY” near page A 12 in the arrangement of sections.

- Section 112 grants the right to inspect the register of members.

- Section 372 also addresses shareholders’ right to information about persons with significant control, as the company is obligated to disclose such details.

– Sections: 112, 119–123, 417–423 (annual returns)

– Pages:- Section 112 is on page A 6–A 7 (snippet “CHAPTER 6—MEMBERSHIP OF THE COMPANY”).

- Sections 119–123 are on pages A 88–A 89 (snippet “DISCLOSURE OF PERSONS WITH SIGNIFICANT CONTROL”).

Where a company’s share capital is divided into different classes, section 166 provides that the rights attached to a class of shares cannot be varied unless the procedure in the articles is followed or shareholders holding at least three-quarters of the class consent. A dissenting shareholder can challenge a variation under section 167 in court.

– Sections: 166–167

– Pages: A 108–A 109

Members with specified thresholds of shareholding may requisition an extraordinary general meeting. Under section 239 (extraordinary general meeting) and also section 237 (annual general meeting), shareholders can ensure meetings are held.

– Sections: 237, 239

– Pages: Appear under “CHAPTER 10—MEETINGS AND PROCEEDINGS OF COMPANIES,” on or around pages A 14–A 15 in the arrangement of sections.